WEBINAR ON WEALTH AWARENESS

WEBINAR ON WEALTH AWARENESS

“Wealth Awareness Program” An Interactive session

Resource person: Rahul Shukla, Financial Coach & Speaker

Powered by SEBI, AMFI, UTI

Date: Tuesday 14th March 2023

Time: 2.30PM – 3.30PM

Mode: Online Mode; Google meet

Online webinar on Wealth Awareness was conducted in association with SEBI, AMFI, UTI. Mr. Rahul Shukla is a financial coach & a renowned speaker who mainly focus on financial and wealth aspect was the resource person. The session was conducted with an objective to make both the year MBA students aware about purpose and importance of savings & procurement of wealth.

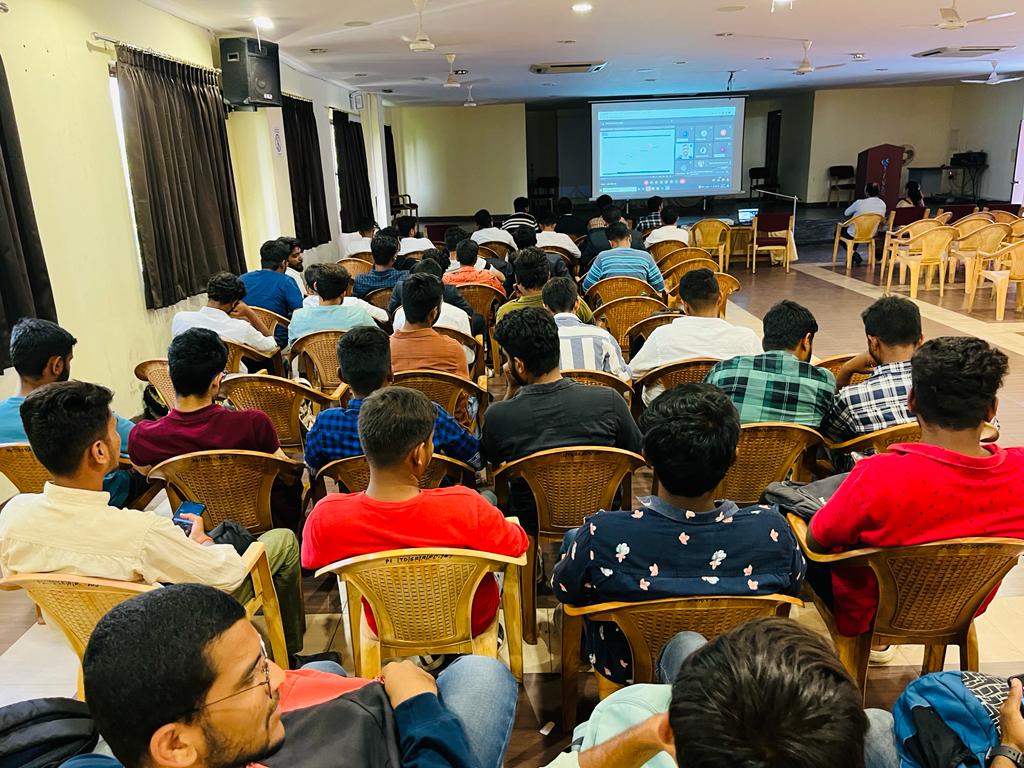

The session started at 2.30PM at MTA Auditorium of our campus, in the presence of our Director Dr. CK Renukarya, HOD DoS Business Administration Prof. Harish Machia, students from 1st year as well as final year & faculties of the department.

Rahul Shukla started the session by giving information about the prerequisites that we to go through before starting our investment plan, he focused on income, cash outflows, expenses & savings aspects. He noted what is the purpose of saving or creation of wealth i.e for future use for the family, education, marriage, assets & retirement. Then emphasized on effect of Inflation which reduces the value of savings and investment, how it occurs, what are its effects, consequences & how to mitigate the loss from inflation.

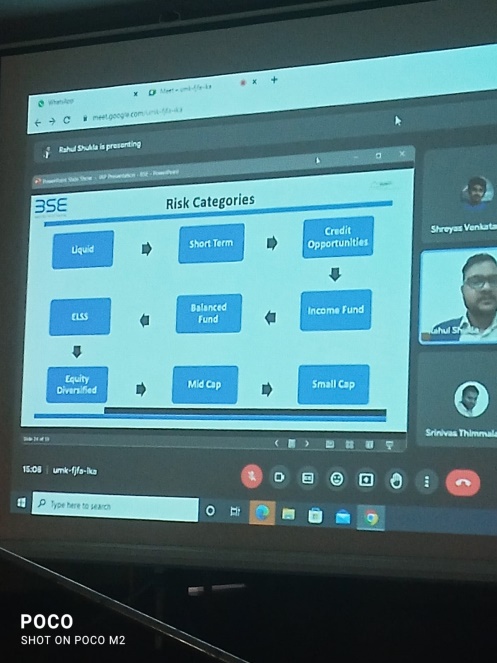

To overcome inflation, he enlightened the students with best possible forms of investment. He explained about fixed deposit scheme, real estate, equity, gold bond, mutual fund which is in order called as Systematic Investment Plan (SIP’s). Amongst these Mr. Shukla concentrated more on equity & mutual funds. He gave some factual data of happenings and returns from the stock market and said that the recent CAGR of SENSEX was 16%.

He gave an detailed explanation about how does mutual fund work, how does fund manager reinvest the investment to the market and how return is provided to investors.

He also gave a brief idea of why SIPs are gaining traction in recent days, the main reason being the flexibility and return associated with it.Since the new tax regime is going on effect from 1st of April 2023, speaker gave a comparison with old tax regime in respect of tax saving benefit.

Then he explained about what are the do’s and don’ts to be taken care while investing in the market, what are the financial product available at BSE, in case of any frauds or mishaps how to raise a complaint and modes of raising compliant to SEBI and how they will encounter the case and solve within 15 working days.

After the session, the platform was provided for interaction. Students had some doubt & clarifications which made them to interact one on one with the speaker. The session was ended at 3.30PM by thanking the speaker Mr. Rahul Shukla & all the personnel who were part of the event.

The Department wishes to place on record our gratitude and thanks to the term of advisors organization for conducting the webinar. The valuable and informative tips, techniques and methodology provided by Mr. Rahul Shukla during the webinar found to be very effective and beneficial by the participants. Special thanks to Mr. Mushir the program Organizer & Ms RakshandaJabeen, Ms Sakshi,and their entire team of Advisor Organization for their contribution to the webinar.

Total number of participants:160